is a car an asset for medicaid

My state doesnt consider the first car as an asset but the equity of the second one is. This vehicle is excluded from the list of assets and is not regarded as a countable asset according to Medicaid rulings so this is one way to spend down.

Can I Sell My Car While On Medicaid Yes Or No Automobtips

In the past a vehicle was exempt only up to a value of 4500 but this no longer holds true.

. Medicaid 5 Posted by 2 days ago Cars as assets I searched for this question and responses are mixed - maybe state-dependent. A qualified attorney uses strategies for asset protection that are ethical legally sanctioned and honest. Under federal regulations one vehicle which in some cases may include a classic car or a luxury car is exempt from Medicaids asset limit regardless of value if specific criteria covered below are met.

A financed vehicle can be considered an asset but only if its value is greater than the amount you owe on it. Medicaid is a Federal Program federally funded administered by the state of Wisconsin but you could run into serious penalties for hiding assets from the Medicaid Program. Since you shouldnt have more than 2000 to qualify for Medicaid you cant buy a car while on Medicaid to avoid losing your Medicaid coverage.

So make sure to spend down the extra asset possessions of you. If a person hides assets or cash to qualify for Medicaid then it is considered as fraud and can result in legal action or prosecution. For example if the cash value is 2000 only 500 would count towards your eligibility limit.

Under federal regulations one vehicle which in some cases may include a classic car or a luxury car is exempt from. Property Your home is likely your most valuable asset but it may not count towards your Medicaid asset test. You can own an automobile and qualify for Medicaid.

Each state has separate Medicaid rules regarding countable assets and what is Medicaid excluded assets. During this timeframe all past asset transfers are scrutinized. Your home may be exempt.

Medicaidplanner Staff answered 3 years ago Yes it can impact your moms Medicaid eligibility as Medicaid has a look-back period. Even with all that in mind a car is an asset because you can quickly put it on the market and convert it to cash albeit for less than what you. Is your mother buying a new car or stopping driving altogether.

For example if you have a car that is worth 10000 and you owe 5000 on it the value of the asset as a whole would be 5000. If you enter a nursing home with the intent to return home and your home is under the equity limits it will not count against your assets. Its against the law.

Any value over 4500 is counted toward the 2000 total assets limitation. In addition personal effects household items a single vehicle and burial plots are exempt from Medicaid eligibility. Funeral and Burial Funds Generally Medicaid considers the value of any non-refundable pre-paid funeral plan or burial contract exempt.

The asset limit for medicaid is 2000. Yes buying a car while on Medicaid will affect your Medicaid because you would be questioned on how you get the money to buy the car. The car has to be bought for transportation purposes not as a luxury item.

If your spouse minor or special-needs child is living there it is automatically exempt. So I do not counsel anyone to hide assets from Medicaid. Even with this value it is important to remember that a car is a depreciating asset.

This is a period of 60-months 30-months in California that dates back from ones Medicaid application date. The couples primary home is also exempt up to a certain amount provided the home is owner-occupied. Medicaid will include the cash value of a life insurance policy over 1500 in their asset test although in a few states this amount varies.

In addition if the individual does not have funeral arrangements already made this can be a great way to plan ahead and reduce assets. Exempt assets will not be counted when determining your eligibility for Medicaid. Medicaid also takes your vehicle into account as an asset and limits each Medicaid recipient to one non-countable vehicle in order to qualify.

Cars as assets. If your asset limit surpasses this value you will be disqualified for medicaid. The answer is probably yes but it depends on the circumstances.

You have to obtain a written letter from a timeshare company depicting that a genuine effort has been made to sell the timeshare and the asset cant be sold or timeshare company will not buy it back. In 2019 for some states this value is 585000 and in other states it is 878000. There will be more scrutiny for the latter.

According to the Florida ESS Policy Manual Section 16400583 and Section 16400591 explain that a single automobile car truck motorcycle etc is excluded as an asset regardless of its value. My state doesnt consider the first car as an asset but the equity of the second one is. Hiding assets can result in not just a denial of benefits but also criminal penalties.

Can you own a car on Medicaid This is a very good question and I see it come up frequently and the short answer is yes you can own one automobile regardless of value generally and qualify for Medicaid as long as this is the automobile you use for your personal use. But If you can showcase that you have done a genuine attempt to make a sale then Medicaid cannot count it as an asset. Are we talking about a 10-year-old Corolla or a brand new Mercedes.

Yes buying a car while on Medicaid will affect your Medicaid because you would be questioned on how you get the money to buy the car. Automobile Not Exempt When a Medicaid client owns a vehicle which does not fall into one of the five exemption categories listed above the vehicle is considered an asset of the clients estate. One automobile of any current market value is considered a non-countable asset for Medicaid purposes as long as it is used for the transportation of the applicant or another member of their household.

We mainly qualify because Im a full-time student and my wife is a stay at home mom of 2. Other vehicles are generally considered extra unless they are very damaged or undriveable. But buying a luxury car while on medicaid can disqualify your medicaid.

According to the Florida ESS Policy Manual Section 16400583 and Section 16400591 explain that a single automobile car truck motorcycle etc is excluded as an asset regardless of its value. This could even be a Lamborghini. However what you can do is do Medicaid pre-planning.

Medicaid And Car Ownership What To Know Copilot

Is A Financed Vehicle An Asset Law Office Of Polly Tatum

Your Guide To Medicaid Countable Assets The Law Office Of Paul Black

How Much Money Can You Have And Still Qualify For Medicaid

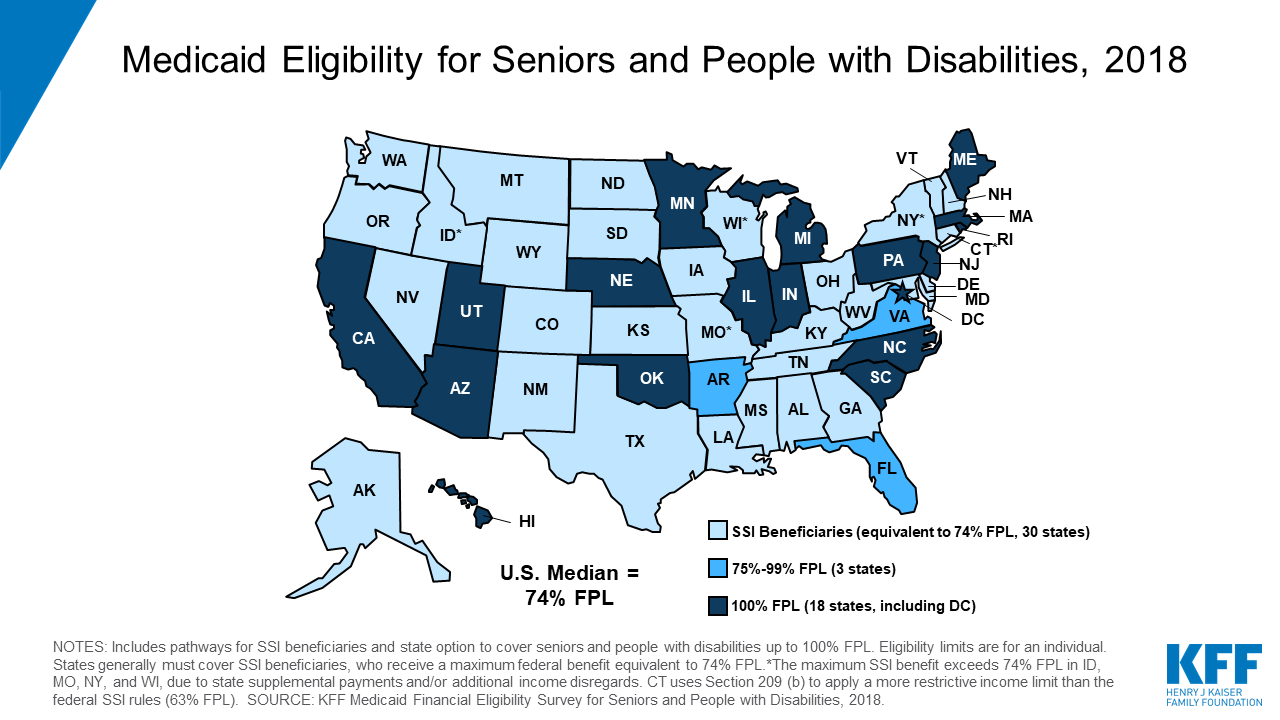

Medicaid Financial Eligibility For Seniors And People With Disabilities Findings From A 50 State Survey Issue Brief 9318 Kff

Spending Down Assets To Qualify For Medicaid Elder Care Direction

What Assets Count For Medicaid Biz Brain Nj Com

Spending Down Assets To Qualify For Medicaid

Can I Sell My Car While On Medicaid Yes Or No Automobtips

How Can I Protect My Assets From Nursing Home Care Indianapolis Estate Planning Attorneys

Transferring Assets To Qualify For Medicaid

Medicaid Rules For A Client Owning An Automobile Sapling

How Do Assets Affect Medicaid Eligibility Richert Quarles

Using A Special Needs Trust To Ensure Your Settlement Does Not Affect Public Benefits Anderson O Brien Law Firm

Medicaid Trust For Asset Protection From Nursing Home Costs

Nursing Home Medicaid Tip Single Or Widowed Case Buy A New Car Law Office Of Glenn A Deig

/Familybuyingnewcar_skynesher_CROPPED_Eplus_Getty-2a8c993cd0c146da9cdcd5c293f766b2.jpg)