omaha nebraska sales tax rate 2021

The latest sales tax rates for cities in Nebraska NE state. Property taxes account for 38 of total state and local tax collections in Nebraska the highest of any tax.

You Have To Claim It Experts Walk Through Nebraska S New School Tax Credit For Property Owners

Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75.

. The minimum combined 2022 sales tax rate for Omaha Nebraska is. There are no changes to local sales and use tax rates that are effective october 1 2021. The local sales tax rate in Omaha Nebraska is 7 as of October 2022.

This is the total of state county and city sales tax rates. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. This form is read only meaning you cannot print or file it.

Sales Tax Rate Finder. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. Average Sales Tax With Local.

Find your Nebraska combined state. The highest sales tax rate in the state is 7 in Hastings. If the tax district is not in a city or village 40 is allocated to the county and.

Groceries are exempt from the Nebraska sales tax. Beginning January 1 2021 the local sales tax rates for Gordon Greeley and Juniata will each increase from 1 to 15 which brings the total to 127 cities in Nebraska. 8 is the highest possible tax.

As we all know. Local Sales and Use Tax Rates Effective April 1 2021 Dakota County and Gage County each impose a tax rate of 05. Rates include state county and city taxes.

State Tax Rates. The average cumulative sales tax rate in Omaha Nebraska is 686. 2020 rates included for use while preparing your income tax deduction.

See the County Sales and Use Tax Rates section at the. Local Sales and Use Tax Rates Effective January 1 2021 Dakota County and Gage County each impose a tax rate of 05. Amended Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Note.

The base state sales tax rate in Nebraska is 55. The current total local sales tax rate in Omaha NE is 7000. Sales taxes are 29 of total tax collections and income taxes are 26.

What is the sales tax rate in Omaha Nebraska. The Nebraska state sales and use tax rate is 55 055. The Nebraska Sales Tax Rates Calculator can help identify the applicable sales tax rate for any location in Nebraska.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. Make a Payment Only. The omaha sales tax rate is.

The Nebraska state sales and use tax rate is 55 055. The December 2020 total local sales tax rate was also 7000. Sales and Use Tax.

Request a Business Tax Payment Plan. The minimum combined 2021 sales tax rate for omaha nebraska is. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

Lawmakers are questioning a proposal that would raise Nebraskas state sales tax and steer the extra revenue into tax credits for low-income residents and property owners. Counties and cities can charge an. See the County Sales and Use Tax Rates section at the.

Changes in Local Sales and Use Tax Rates Effective January 1 2021. Federal excise tax rates on beer wine and liquor are as.

Third Time Is The Charm For 900 Million Tax Cut Plan In Nebraska Legislature Nebraska Examiner

U S Cities With The Highest Property Taxes

Nebraska Sales Tax Guide For Businesses

Earn Up To 000 In Tax Credits Nebraska Microentrerprise Tax Credit

Omaha Nebraska Property Taxes Explained Youtube

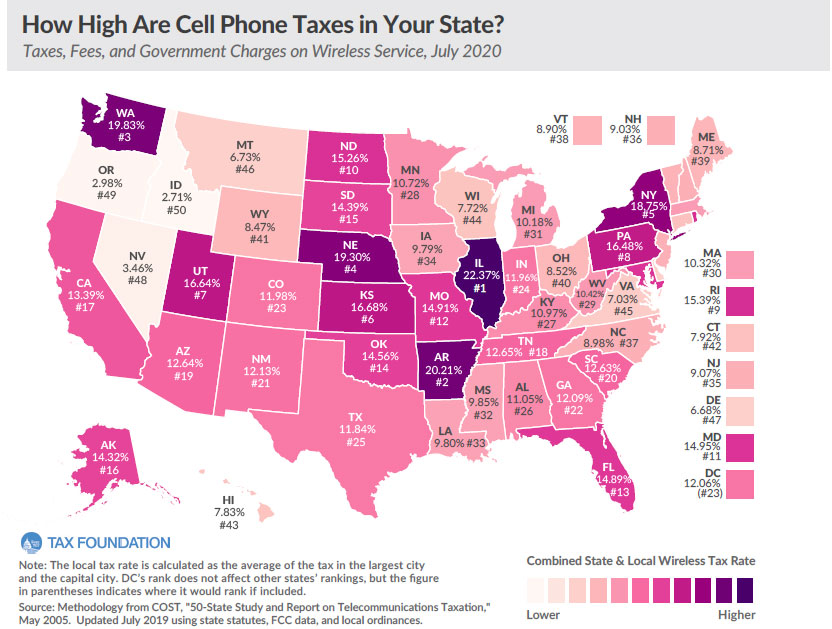

Nebraska Has 4th Highest Wireless Tax Burden In The Nation

Sales Taxes In The United States Wikipedia

Pro And Con Tax Provisions In The Build Back Better Act

Historical Nebraska Tax Policy Information Ballotpedia

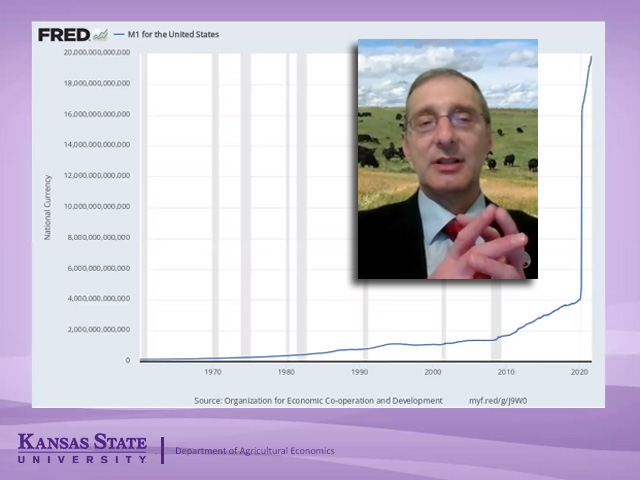

Taxes And Spending In Nebraska

4730 1 2 State Cir Omaha Ne 68152 Mls 22126399 Redfin

Sales Tax Rate Finder Nebraskamap

Nebraska Sales Tax Rate Table Woosalestax Com

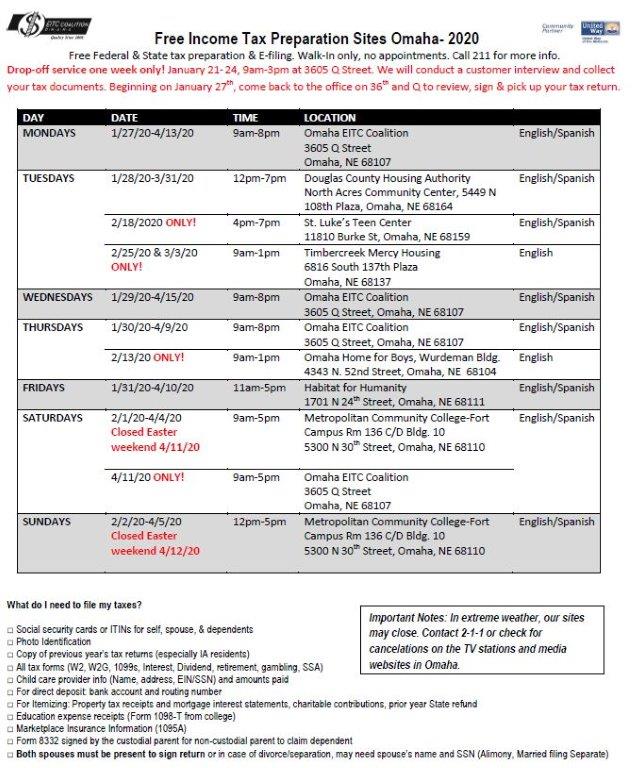

Free Tax Preparation Sites In Omaha Nebraska Department Of Revenue

Conroe Isd Board Of Trustees Approves 619 83 Million 2022 23 Budget Tax Rate Community Impact

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

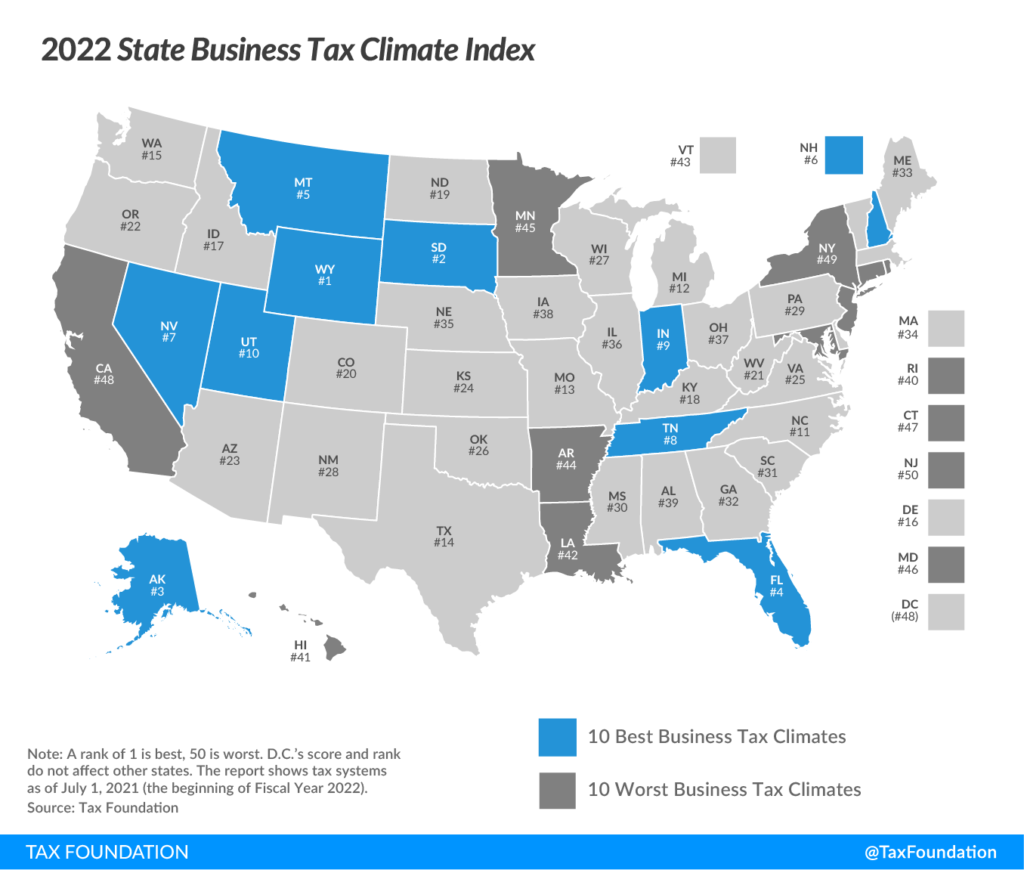

Nebraska Drops To 35th In National Tax Ranking

What You Need To Know About Omaha Property Taxes Mortgage Specialists